Amazon has announced plans to eliminate close to 16,000 positions in a fresh round of job reductions, part of a wider corporate effort to trim costs and sharpen the company’s focus on higher-margin businesses. The cuts, the latest in a string of workforce reductions across Big Tech, will touch a range of teams and geographies as Amazon adapts to a softer consumer environment and recalibrates investments made during its pandemic-era expansion.

The company framed the move as a strategic reset: shifting resources away from lower-priority projects and toward cloud computing, advertising and artificial-intelligence initiatives that promise stronger returns. That pivot follows years of heavy hiring in fulfilment, streaming content, devices and experimental labs — investments that boosted capacity but also inflated operating costs when consumer demand cooled and macro uncertainty rose.

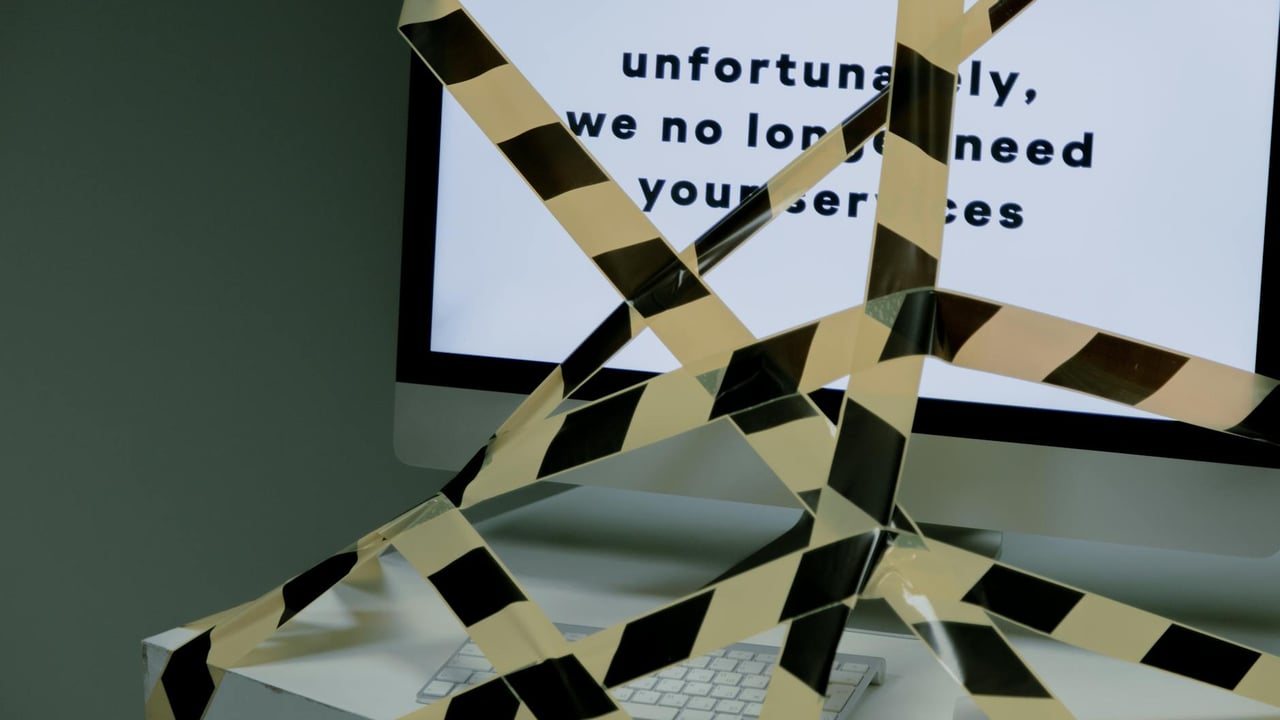

For employees and labour advocates the announcement raises immediate concerns about livelihoods and workplace morale. Amazon’s sprawling workforce spans corporate engineers, fulfillment-centre staff, logistics contractors and retail operations; cuts of this scale will have uneven local impacts depending on where roles are concentrated and which business units are pared back.

For investors and competitors, the layoffs signal Amazon’s intent to prioritise margin recovery and product areas with clearer monetisation pathways. Cloud services (AWS), programmatic advertising and enterprise AI products represent the most obvious targets for reinvestment; the company’s ability to reallocate capital effectively will determine whether this round of cuts improves profitability or simply reduces headcount without addressing structural issues.

The announcement also sits within a broader industry context: a multi-year wave of tech job reductions followed soaring hiring during the pandemic. Firms are navigating slower growth, rising interest-rate pressures and shifting consumer behaviour. Amazon’s move may accelerate automation in logistics and reinforce a trend toward leaner head counts across e-commerce and cloud services, while inviting renewed scrutiny from regulators and labour organisers over the social costs of rapid restructuring.

Operationally, Amazon faces trade-offs. Reducing staff can lower short-term costs and appease markets seeking healthier margins, but the company risks degrading customer experience, lengthening delivery times or slowing product development if cuts are too deep or poorly targeted. The next few quarters will be revealing: markets will watch revenue and margin trajectories, while rivals may seize openings in segments where Amazon thins its presence.

Finally, the cuts underscore a strategic question facing the wider technology sector: whether firms can successfully pivot from scale-driven growth to profitable, product-led businesses without sustained pain for workforces and communities. Amazon’s choice to focus on cloud, advertising and AI suggests it views those areas as the engines of a more durable business model — but delivering that transformation will require clear execution and a careful balancing of cost savings against long-term capabilities.